Afdhel Aziz's tour de force of 'The Power Of Purpose' in Forbes 👍👍👍

Great summary with stat's of why purpose is important for companies for its employees and investors:1. 64% of Millennials won’t take a job if their employee doesn’t have a strong CSR... and millenials will make 75% of the workforce by 2025

2. Gen-Z is coming into the workforce and is the first generation to prioritize purpose over salary

3. purpose-driven companies had 40 percent higher levels of workforce retention than their competitors

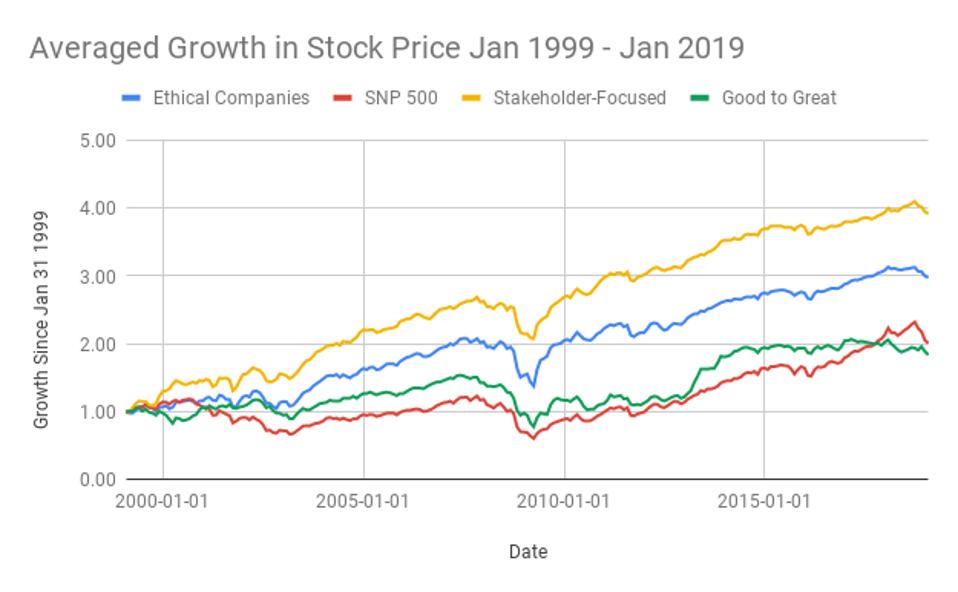

And for investors a long-term study by the Torray project show that ethical and stakeholder-focus is a driver for stock returns.

UBS increases impact investments, but tightens rules on energey 👊👊👊

"‘Sustainable’ investments rose by more than 50% to nearly $500 billion in 2019, while lending to the energy and utilities sectors fell by 40% as it tightened its rules."

The bank had toughened guidelines for lending to the energy sector and is not financing new greenfield thermal coal mines, offshore oil projects in the Arctic or greenfield oil sands projects.

The bank also outlined rules for lending to firms that have >30% reserves or production in Arctic oil and/or oil sands.

Why it remains confusing to invest in ESG 😕😕😕

Opinion piece in the Financial Times outlining some of the issues investors face when investing in ESG and when one looks beyond the 'labels' and 'buzzwords' associated with funds and management companies: ethical, impact, socially responsible or just ESG.